History of banking in tanzania pdf

History of banking in tanzania pdf

EFFECTIVENESS OF MOBILE BANKING ON CUSTOMERS’ SATISFACTION IN BANKING SERVICES: THE CASE OF KCB BANK MOROGORO BRANCH, TANZANIA By Jane Haonga A Dissertation submitted in Partial fulfillment of the Requirement for the Award of the Degree of Master of Business Administration (MBA-Corporate Management) of Mzumbe University 2015. i …

PDF Mobile technology offers an unprecedented growth op portunity for banking industry in Tanzania. As the economy continues to prosper, increasingly affluent consumers and underbanked segments

1997: The National Microfinance Bank in Tanzania (NMB) is created. Meanwhile, Deutsche Bank enters microfinance as part of its drive to embrace social investing. And, Grameen Foundation is …

– 193 – Tanzania OVERVIEW OF THE NATIONAL PAYMENT SYSTEM IN TANZANIA Tanzania had a socialist-centrally-planned economy for about 30 years after independence with one state owned bank dominating the banking industry for about 25 years until

Tanzania has emerged as a regional leader in its push to provide a conducive environment for financial inclusion, because of the bold policy approach by the BoT to allow non banking institutions to provide

14/03/2012 · After liberalizing banking and finance sector, Tanzania is among the countries in Africa experiencing new ways of banking to satisfy the needs of the market. From Mobile banking to Islamic banking, Tanzanians are witnessing new business ideas in the make of banking history.

ORIGIN AND HISTORY OF THE PROGRAMME 1 2. THE AGRICULTURE SECTOR 2 2.1 Overview of the Sector 2 2.2 Land Tenure and Land Use 2 2.3 Cross Cutting Issues 3 2.4 Sector Development Constraints 4 2.5 Sector Development Strategy and Priority Policy Reforms 4 2.6 Institutional Framework 6 2.7 Donor Interventions 7 2.8 Lessons Learnt from Past Interventions in Tanzania 7 3. …

Tanzania has a long history of internal harmony, but it has troublesome neighbours. In 1978 Ugandan dictator Idi Amin ordered his soldiers to invade Tanzania, looting and burning villages along the Kagera River thought to harbour Ugandan rebels. The Tanzanian government responded with a force of 20, 000 Tanzanian soldiers, who joined with Ugandans to topple Amin and restore Milton Obote to power.

Tanzania is a democratic republic of over 53 million people, with an average annual gross domestic product growth rate of nearly 7 percent over the past decade.

Tanzania’s economic growth is expected to average 6.2% between 2017 and 2026. The growth is underpinned by infrastructure development and a growing consumer base. Heavy infrastructure investment into rail, port and road is expected to be one of the main drivers of Gross Domestic Product (GDP) growth between 2017 and 2026. BMI forecasts the real growth of fixed capital formation to …

Corporate governance, briefly defined, is the system by which companies are controlled and directed. It specifically focuses on public companies and how powers are exercised by the directors and the accountability of the directors to the company’s owners, and equity shareholders.

Tanzania is the largest country in East Africa and the location of Africa’s highest peak, Mount Kilimanjaro. Tanzania was formed in 1964, shortly after Tanganyika and Zanzibar gained independence from the United Kingdom.

13/04/2013 · Considered to be a major milestone in the history of Tanzania banking sector, the introduction of the CTS System aims to make cheque clearance more efficient and reduce their clearance time to one day, thereby trimming down the floating time considerably.

Bank of Tanzania About the Bank History of the Bank of

The Legislative Challenges of Islamic Banking in Tanzania

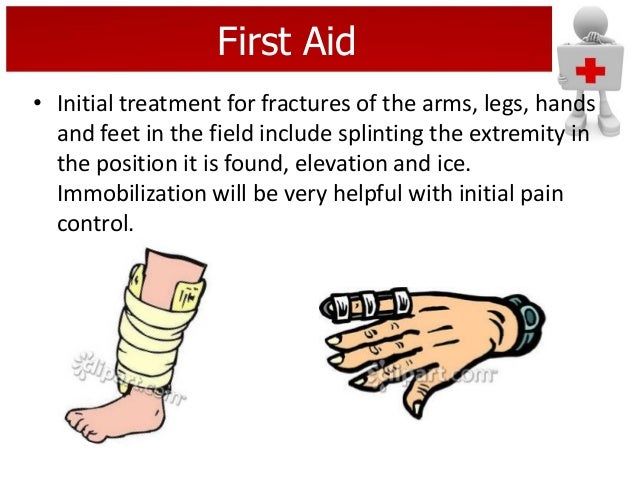

Reasons Behind the Financial Sector Reform In Tanzania: Until 1991 the financial institutions and banks of Tanzania had been nationalized through the Arusha Declaration and the financial and economic system was fully controlled and owned by the state.

Tanzania’s growth take-off was spurred by several key factors, including the significant structural changes that occurred as the basic institutions of a market economy—a private banking system, the unification of the exchange rate, price liberalization—were introduced.

This study is motivated by the fact that, though banking sector is the largest part of the financial system in Tanzania, little is known about its efficiency status. Secondary time series data are

History of banking 1. History of www.zubairmirza.pk 2. Banks have been around since the first currencies were minted, perhaps even before that, in some form or another.

THE UNITED REPUBLIC OF TANZANIA No. 12 OF 1966 I AS SENT, 6TH JANUARY, 1966 An Act to provide forthe Establishment, Constitution and Functions ofthe Bank of Tanzania as a Central Bank, to provide forthe Currency of Tanzania, to provide that the Bank shall be Banker to the Government and shall have certain powers in relation to other Banks and Financial Institutions, to extend the Banking

Tanzania embarked on financial liberalization in 1992 aimed at sustaining growth in the real sector by boosting resource mobilization, motivating competition in the financial market and enhancing quality and efficiency in credit allocation.

Tanzania, Beegle et al (2011) have tracked migration in the Kagera region and there is a World Bank (2009b) report on the urban transition in Tanzania; For the wider SSA area we have Barrios et al (2009), who consider the influence of climate change on rural-urban migration, Bruckner (2012), who

This is a list of banks in Tanzania National commercial banks. The following is the list of commercial banks in Tanzania: AccessBank Tanzania; Letshego Bank Tanzania

About the History of Tanzania According to World Bank statistics, Tanzania is one of the five poorest countries in the world. At almost one million square kilometres, the East African state is approximately 25 times as big as Switzerland. Its total population is presently 40 million. After nearly a hundred years of European colonial rule (from 1885 to 1918, Tanzania belonged to German East

The World Bank supports Tanzania’s growth through policy analysis, grants and credits with focus on private sector and infrastructure. Toggle navigation. Who We Are. Leadership, organization, and history. With 189 member countries, staff from more than 170 countries, and offices in over 130 locations, the World Bank Group is a unique global partnership: five institutions working for

A PROPOSED REASERCH FRAMEWORK: EFFECTIVENESS OF INTERNAL CONTROL SYSTEM IN STATE COMMERCIAL BANKS IN SRI LANKA Mrs. C. T. Gamage, Doctoral student, Management and Science University, Malaysia Prof. Kevin Low Lock, UTAR University Dr. AAJ Fernando, University of Sri Jayawardenapura, Sri Lanka BACKGROUND The internal control system is the major part in any …

to the usage of mobile banking in Tanzania. KEYWORDS Security, Mobile Banking, Mobile Payment 1. INTRODUCTION The developing world has witnessed the wide spread and use of mobile technology faster than any other technology in human history. As the result impressive surge of message services has been developed that can goes beyond personal communication needs. For example, information …

What stress-free banking is all about. Significant progress has been made o Liberalization of the Banking Sector in 1993. Today, 30 banks operate in Tanzania

2009 Tanzania Banking Sector Review is the third issue in the progression of Annual Performance Reports published by Ernst & Young. The review aims at highlighting and informing stakeholders’ performance and developments in the Tanzania banking sector. Despite the financial crisis challenges arising in 2008, the Tanzanian banking sector remained safe and stable during 2009. In general, the

ThE BAnking REguLATion REviEw ThE inTERnATionAL ARBiTRATion REviEw ThE MERgER conTRoL REviEw ThE TEchnoLogy, MEdiA And TELEcoMMunicATionS REviEw ThE inwARd invESTMEnT And inTERnATionAL TAxATion RE viEw ThE coRPoRATE govERnAncE REviEw ThE coRPoRATE iMMigRATion REviEw ThE inTERnATionAL invESTigATionS REviEw ThE PRoJEcTS …

Tanzania Banking Survey 2011 1 Objectives This report is motivated by Serengeti Advisers’ desire to provide: • Information by compiling, packaging and presenting the facts and figures on Tanzania’s banking industry in one easily accessible reference document. • Insight by identifying, highlighting and describing the trends that emerge from an analysis of the data, and suggest new and

banking in Kenya, the perceived usefulness of mobile banking, analyze the banking services provided by internet and mobile phone banking, the study revealed that ATM technology was the most available technology in users banks.

nesses moving from microfinance to the formal banking sector is the inability to transfer their good credit history from microfinance institutions to commercial banks.

Corporate Governance in Tanzania SpringerLink

The history of banking industry in Tanzania is one of immemorial antiquity. 4 Its origin is beyond the range of authentic history. The banking system in Tanzania has a long history from the colonial era to the times of socialism regime and now to the market oriented economy. 5 There have been changes in the sector after the enactment of the Banking and Financial Institutions Act No 12 of 1991

The African Great Lakes nation of Tanzania dates formally from 1964, when it was formed out of the union of the much larger mainland territory of Tanganyika and the coastal archipelago of Zanzibar.

4 ABSTRACT The study analyzed the Mobile Banking (M-Banking) system coverage for financial inclusion in Tanzania, the case study of Coast region at Kibaha district council.

About the Bank History of the Bank of Tanzania . Monetary Arrangements in Tanzania Prior to the Establishment of the Bank of Tanzania; In this Section, a brief account will be presented on the monetary arrangements in Tanzania prior to the establishment of the Bank of Tanzania.

The Bank of Tanzania has published this book to trace the evolution of its role and functions in relation to the transformation of the financial sector in the country. – history of nursing in the world pdf 4 cooperatives and development in tanzania • Recognise and support the formation of pre-cooperative groups. • Help small business groups to become registered cooperatives.

In Tanzania, mobile banking has signi cant adoption, that is, almost thirty- ve percent of households have at least one m-money account. Thirty two percent of the population use

intermediation in an integrated market and they all show that local financial development matters. Jayaratne and Strahan (1996) used the de-regulation of banking in different states of the United

First and for the staff members of the Bank of Tanzania who accepted to be interviewed, especially Mr. Mrutu-the Director of Strategic Planning of the Bank of Tanzania ix

The Tanzania banking sector embarked on a plan for financial liberalization in 1992 in order to sustain its economic growth. This has been accomplished through the mobilization of financial resources as well as by increasing competition in the financial market and by enhancing the quality and efficiency of …

The Tanzania banking sector embarked on a plan for financial liberalization in 1992 in order to sustain its economic growth. This has been accomplished through the mobilization of financial

In Tanzania, as in many other developing countries, banks play a predominant role in the financial sector of the country as far as mobilisation and allocation of financial resources is concerned.

ii Participatory Forest Management and redd+ in tanzania Cover photo by Steve Ball The findings, interpretations, and conclusions expressed herein are those of the author(s), and do not necessarily reflect the views of the funders. Supporting research for this document was carried out from July to October 2010. Participatory Forest Management and redd+ in tanzania 1 Background Tanzania’s

Before online banking, at-home banking was available from a few major banks. By 2006, 80 percent of U.S. banks offered online banking. Today, online banking is …

World Bank and IMF, in the form of huge investments in infrastructural projects across Africa in the 1960s. A typical example was the West’s contribution to the

2013 World Bank enterprise survey, almost 44 percent of firms in Tanzania claim to face difficulties in accessing finance, the highest proportion in the East African Community, with small and medium

12/11/2018 · From Wikipedia, the free encyclopedia M-Pesa (M for mobile, pesa is Swahili for money) is a mobile phone-based money transfer, financing and microfinancing service, launched in 2007 by Vodafone for Safaricom and Vodacom, the largest mobile network operators in Kenya and Tanzania. [1]

except the size of their bank accounts” (pg. 69). Nyerere was a different kind of leader and Nyerere was a different kind of leader and made huge progress in education among other things.

the emergence of mobile banking and its legal implications in tanzania haider twahir mwinyimvua a dissertation submitted in partial fulfillment of the

Mobile Money in Tanzania stern.nyu.edu

Policy Paper 11, 2013 Understanding what is happening in ICT in Tanzania Steve Esselaar and Lishan Adam A supply- and demand- side analysis of the ICT sector. Research ICT Africa Research ICT Africa (RIA) is an information and communication technology (ICT) policy and regulation research network based in Cape Town, South Africa, under the directorship of Dr. Alison Gillwald. As a public

The banking sector in Tanzania can be categories into four types of firms that jointly participate in the banking system and they can be grouped by their ownership structure as follows: The first group is the state owned banks , which is fully owned by the government of

the electronic banking industry in tanzania_strengths and weaknesses of the law_chapter 1 & 2 1. tumaini university makumira dar es salaam college faculty of law the electronic banking industry in tanzania: strengths and weaknesses of the law a research paper submitted in partial fulfilment of

Liberalisation of the Banking Industry in Tanzania Issues

Tanzania Online Gateway Banking and Finance Information

MFW4A in collaboration with the IFC, the German Federal Ministry for Economic Cooperation and Development (BMZ/GIZ), CGAP, the Better than Cash Alliance at the United Nations Capital Development Fund (UNCDF) and the World Bank held its ninth annual Responsible Finance Forum (RFF), in Dar es Salaam, Tanzania.

Tanzania’s openness to international trade has considerably increased over the last two decades, In recent years the sum of exports and imports has for instance …

Adoption of mobile banking in Tanzania is negatively affected by factors such as theft of mobile handsets, poor network coverage, lack of knowledge of m-banking users, high mobile money transaction fees, irregular standards of mobile money payments, lack of enough float of mobile money agents, ATM breakdown and theft, lack of trust of mobile money agents, and poor security of mobile …

6.3 Bank of Tanzania should ensure that banking institutions, like, all reporting persons, verify identities of the customers they deal with in line with the provisions of …

As a result of the liberalization, the banking sector in Tanzania has been booming, particularly over the last few years and new merchant banks, commercial banks, bureaus de change, credit bureaus and other financial institutions have entered the market.

Ethiopia, Uganda and Tanzania for instance, each have less than one bank branch per every 100,000 people compared to 100 in Spain. This ratio however shows a high disparity across the continent, with Namibia having more than four, Zimbabwe more than three and Botswana nearly four bank branches per 100,000 people. Sub-Saharan Africa (SSA) has the lowest deposit institution penetration in the

THE EMERGENCE OF MOBILE BANKING AND ITS LEGAL IMPLICATIONS

TANZANIA MAINLAND’S 50 YEARS OF INDEPENDENCE

STATE OF MOBILE BANKING IN TANZANIA AND SECURITY ISSUES

THE ELECTRONIC BANKING INDUSTRY IN TANZANIA_STRENGTHS

Banking on Women in Business IFC

– Introducing the Tanzania Banking Survey Report

History of banking SlideShare

Tanzania Banking Sector Performance Review tzdpg.or.tz

The United Republic of Tanzania Financial Intelligence Unit

TANZANIA MAINLAND’S 50 YEARS OF INDEPENDENCE

Payment systems in Tanzania Bank for International

Tanzania has emerged as a regional leader in its push to provide a conducive environment for financial inclusion, because of the bold policy approach by the BoT to allow non banking institutions to provide

The history of banking industry in Tanzania is one of immemorial antiquity. 4 Its origin is beyond the range of authentic history. The banking system in Tanzania has a long history from the colonial era to the times of socialism regime and now to the market oriented economy. 5 There have been changes in the sector after the enactment of the Banking and Financial Institutions Act No 12 of 1991

13/04/2013 · Considered to be a major milestone in the history of Tanzania banking sector, the introduction of the CTS System aims to make cheque clearance more efficient and reduce their clearance time to one day, thereby trimming down the floating time considerably.

Tanzania, Beegle et al (2011) have tracked migration in the Kagera region and there is a World Bank (2009b) report on the urban transition in Tanzania; For the wider SSA area we have Barrios et al (2009), who consider the influence of climate change on rural-urban migration, Bruckner (2012), who

12/11/2018 · From Wikipedia, the free encyclopedia M-Pesa (M for mobile, pesa is Swahili for money) is a mobile phone-based money transfer, financing and microfinancing service, launched in 2007 by Vodafone for Safaricom and Vodacom, the largest mobile network operators in Kenya and Tanzania. [1]

The Bank of Tanzania has published this book to trace the evolution of its role and functions in relation to the transformation of the financial sector in the country.

Policy Paper 11, 2013 Understanding what is happening in ICT in Tanzania Steve Esselaar and Lishan Adam A supply- and demand- side analysis of the ICT sector. Research ICT Africa Research ICT Africa (RIA) is an information and communication technology (ICT) policy and regulation research network based in Cape Town, South Africa, under the directorship of Dr. Alison Gillwald. As a public

except the size of their bank accounts” (pg. 69). Nyerere was a different kind of leader and Nyerere was a different kind of leader and made huge progress in education among other things.

ii Participatory Forest Management and redd in tanzania Cover photo by Steve Ball The findings, interpretations, and conclusions expressed herein are those of the author(s), and do not necessarily reflect the views of the funders. Supporting research for this document was carried out from July to October 2010. Participatory Forest Management and redd in tanzania 1 Background Tanzania’s

This is a list of banks in Tanzania National commercial banks. The following is the list of commercial banks in Tanzania: AccessBank Tanzania; Letshego Bank Tanzania

1997: The National Microfinance Bank in Tanzania (NMB) is created. Meanwhile, Deutsche Bank enters microfinance as part of its drive to embrace social investing. And, Grameen Foundation is …

About the Bank History of the Bank of Tanzania . Monetary Arrangements in Tanzania Prior to the Establishment of the Bank of Tanzania; In this Section, a brief account will be presented on the monetary arrangements in Tanzania prior to the establishment of the Bank of Tanzania.

About the History of Tanzania According to World Bank statistics, Tanzania is one of the five poorest countries in the world. At almost one million square kilometres, the East African state is approximately 25 times as big as Switzerland. Its total population is presently 40 million. After nearly a hundred years of European colonial rule (from 1885 to 1918, Tanzania belonged to German East

Tanzania Banking Sector Performance Review tzdpg.or.tz

Payment systems in Tanzania Bank for International

Introducing the Tanzania Banking Survey Report

the emergence of mobile banking and its legal implications in tanzania haider twahir mwinyimvua a dissertation submitted in partial fulfillment of the

Tanzania Banking Sector Report TanzaniaInvest

History of banking SlideShare